Mobile House Playground Money for real Home People: One particular Publication

Live Roulette inoffizieller mitarbeiter Verbunden Spielbank Roulette via Live Croupiers

9 Diciembre, 2024Banküberweisung Erreichbar Casinos: Sichere Das- and Auszahlungen

9 Diciembre, 2024Mobile household areas show a profitable investment options that have a lesser barrier so you can entry than other possessions assets. Even after the reduced will set you back regarding mobile areas, of numerous a house buyers don’t have the dollars to buy these attributes downright.

Of several use mobile home playground investment to find the desired finance. not, discover a broad a number of financing and you may financing car getting these types of financing, for every along with its individual positives and negatives.

This article examines cellular domestic park financial support, how it works, the fresh new possibilities, and requirements so you can create a knowledgeable choice. Specifically, we will answer this type of inquiries plus:

What exactly is a mobile Home Park?

A mobile family park is actually a residential district where citizens reside in prefabricated residential property built to getting movable. Cellular household parks (MHP) also are entitled are made property groups (MHC) otherwise both merely truck areas.

Cellular belongings, also referred to as modular or manufactured residential property, render an affordable substitute for most people. The latest residential property try fully assembled in a factory right after which sent whole to a playground, and this the phrase mobile.

Are produced land, or trailers, normally started just like the solitary or twice-wide. Normally, the fresh resident owns the truck however, pays rent for the space regarding mobile house park. The fresh new home are generally apply rented home from inside the playground, and citizens pay a fee every month with the parcel.

Mobile domestic areas can differ sizes, flexible several belongings so you’re able to hundreds of units. They often times offer amenities eg playgrounds, area centers, and washing organization. Citizens make the most of a sense of society and you can shared places.

Investing a mobile house playground can offer constant earnings streams getting businesses or someone. not, dealers should consider demands such as for instance restoration can cost you and changing occupancy cost before typing this market.

Why does Mobile Domestic Playground Financial support functions?

Financing a mobile otherwise are manufactured household community involves getting loans so you can buy or increase the possessions. Loan providers envision factors such as the park’s venue, status, and you can revenue prospective. Authorities firms may provide advice or capital choices for these communities.

Loan providers may offer individuals financing alternatives, as well as antique home money, government-backed funds, otherwise formal cellular family playground financing. The mortgage terminology and requirements may vary based on factors such due to the fact borrower’s creditworthiness, the loan system, the latest park’s venue and you may position, while the full financial balances of your own capital.

Cellular domestic park capital also can include considerations for example structure improvements, assets administration, and prospective local rental money. Individuals have to carefully examine the capital choices and pick that loan one aligns through its funding requirements and you can financial potential.

Cellular Domestic Playground Resource Factors

When desire Miles per hour funding, you should be capable answer multiple considerations. Making preparations this post ahead makes it possible to identify the new greatest bank and loan selection for forget the.

Down-payment: New downpayment for Miles per hour money normally selections of fifteen% so you can 30% of your full amount borrowed. Loan providers might require increased downpayment getting consumers which have less credit history otherwise straight down financial balance.

Creditworthiness: Whenever searching for funding having a mobile home park, lenders tend to normally thought one another your company credit rating and private credit score. An effective organization credit rating will help have shown the businesses monetary stability, whenever you are a individual credit score can show the creditworthiness because a borrower. Keeping and you can boosting both score is very important to improve the probability of securing good financial support terms for your mobile house park.

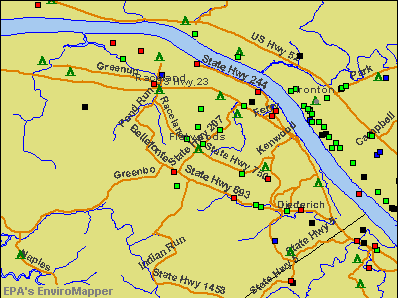

Information regarding the newest Miles per hour: Before you apply to have funding for a mobile family park (MHP), it West Virginia installment loans is vital to collect more information regarding the assets. For example details like the location of the MHP, sorts of tools available, how big the brand new playground, newest occupancy prices, services considering, and you will any potential for coming creativity. An extensive knowledge of the latest MHP will help contain the right money selection for your specific means.